A version of my presentation to the Church Investors Group (CIG), November 20 2020

My name is Paul Lee, and I am an investor. I have been in the City for 20 years now, first for more than a dozen years at Hermes, helping create and build its Equity Ownership Service (EOS) business and most recently at Aberdeen Asset Management, leading its stewardship efforts, and leaving following the merger with Standard Life. I am now an independent consultant, mostly to investment institutions.

But I am here to talk with you today about fairness. It’s an issue that I have done a good deal of thinking about over the years, and most particularly over the last two years in which I have been writing a blog on the topic. That blog and the issues it discusses seem to have gained a good deal more resonance in this year of Covid when many more people have been thinking about the role of business in society and how business, and investment, can more clearly be seen as working in the interests of all of their stakeholders.

I’m going to talk about two things in particular:

- First, how fairness is central to how we as humans view the world, and central to our understanding of how we want our world and our communities to be.

- Second, how this understanding might help us think about our role as investors and how we might best address some of the challenges our world faces.

Before that though, I should just talk about what fairness is. It is actually one of those things that is hard to define, but we certainly, viscerally know when it is absent. Unfairness is something that troubles people on a very fundamental level and language around fairness is central to how we want our world to be: we talk about level playing fields and removing unfair barriers to both competition and individual advancement. But fairness is not the same as equality; it is a sense, a feeling, not a number.

Economists love inequality. Actually, some economists probably do love inequality but what I mean to say is that economists love the concept of inequality and talking about it. They measure it in precise detail, usually using the Gini coefficient, which measures disparity in either wealth or income, and largely ranges in practice from around 0.65 for the highly unequal South Africa to just under 0.3 for more egalitarian Scandinavian countries. For me, the fact that inequality can be reduced to single numbers like this makes it less meaningful for people.

But crucially, inequality is less interesting than fairness because humans can stand some inequality – it is acceptable for us where individuals do better because they have particularly valued talents, or are particularly hard-working, or even where they enjoy particular luck. What is not acceptable, the inequality that humans cannot stand, is where that inequality arises from unfairness. And I don’t think it is controversial to say that this is something that the world is currently suffering from.

Now I promised you a human view of fairness. But actually I am going to start with some of our brethren, capuchin monkeys. They also display a sense of fairness, as can be seen in this video. It is taken from a talk by a great Dutch zoologist Frans de Waal who has done more than anyone to reveal the inner lives of our ape brethren (I would heartily recommend his book Mama’s Last Hug in particular). These capuchins are happy to perform a small task for the reward of a piece of cucumber. That is, they are until it seems that their fellows are rewarded for the same task with a grape. Let’s see.

So capuchins have a sense of fairness. But it seems to me a selfish form of the sense of fairness, righteous anger when another does better out of a given situation. It’s the same sense of fairness expressed by the six-year old stamping their foot and yelling “It’s not fair” when things do not turn out precisely to their liking. Yet humans show not just this selfish form of the sense of fairness but an unselfish form, an altruistic sense of fairness. Indeed, there’s evidence that even 15 month-old humans can show an altruistic sense of fairness.

Adult humans show this altruistic sense of fairness too – and apparently universally so, across cultures, across geographies. The main way that this has been studied and shown by social scientists is through two tests, called the Ultimatum Game and the Dictator Game.

In the Ultimatum Game an individual is given a pot of money and invited to give any chosen portion of it to the other player. The recipient has a simple choice – either they take what they are offered and the two players walk away with their resulting outcome, or they refuse, in which case neither party gets anything at all. Now, if we listened to economists and were actually their version of humanity, homo economicus, the recipient would accept any offer that left them with something other than zero. But we aren’t, and I am sure you are all imagining what you yourselves might do in this game, what offer you might make and what offer you would be willing to accept. We’ll look at some real world evidence in a moment.

The Dictator Game is a simplified version of the Ultimatum Game. Again the offeror is given a pot of money, but this time they are a dictator because whatever allocation they make automatically happens. The recipient is given no choice to make at all. Clearly, in this game only one of the two individual’s view of the sense of fairness matters rather than it being a matter of the interaction of two individuals’ sense of fairness. Again, no doubt you are considering what outcome you might impose were you a dictator.

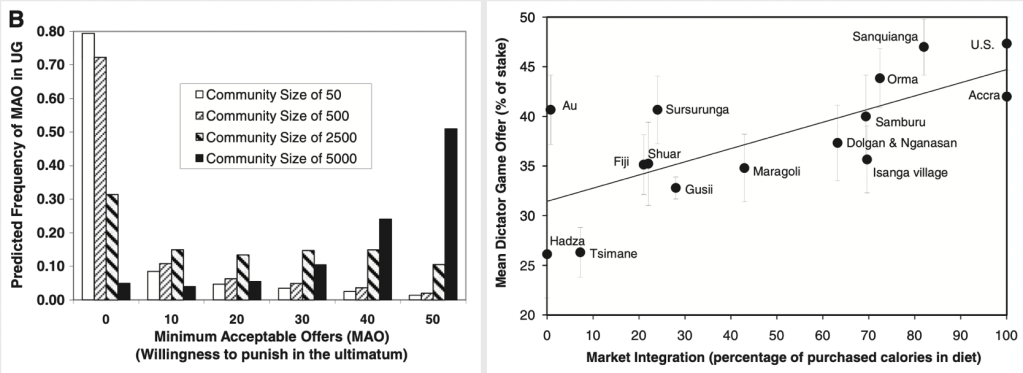

There have been many studies, and here is just an example of the largely consistent outcomes from them:

This study considers a range of scales and styles of community and tries to identify differences. The first thing to note though is the consistency– nowhere in this study does the average dictator proffer less than a quarter of the pot, even though economics would argue that they should hand over nothing. In many places the award is near to half of the overall pot – even in the highly unequal and unfair US (about which more later). Again, in most communities of any size the study shows that really the only acceptable Ultimatum Game offer is around 50% of the pot.

One might suggest that the reason why smaller communities, or those less involved in markets, are less demanding of fairness in each transaction is that they have a greater sense that what goes around comes around – that there will be a further transaction with the individuals in question and fairness can be achieved over time. In larger communities (anything more than a small village to most of our perceptions) or where commercial life operates, it seems less certain that there will be further interactions so perhaps we feel obliged to seek fairness at each opportunity.

Members of this audience in particular might have noticed the word ‘religion’ in the title of this study. And you may be gratified to hear that it provides some evidence that participation in ‘world religions’ (here defined simply as either Islam or Christianity) is associated with a greater sense of fairness. However, I am not sure that it is very strong evidence as the only studied community with zero participation in world religion is the Hadza, one of those in the bottom left corner of the dictator game chart; all the others have well over 50% participation, and most are at or near to 100%, so it’s far from clear that that particular finding is strongly meaningful.

While we are on the topic of small communities I want to talk a little about the Ju’hoansi tribe in Namibia. This is a hunter-gatherer tribe, and believed to be one of the few to have a culture that has been consistent for tens of thousands of years. It may therefore offer the best window we have to the cultural outlook that framed the development of the human brain. And the Ju’hoansi have a very interesting approach to success. A hunter returning with a kill is not celebrated but rather teased. The kill itself is denigrated – it was barely worth bringing back to the camp, it will barely feed anyone – that sort of thing. There is a strong sense that individual success should not be praised but rather should be brought low, because what matters is success of the community as a whole – in a real sense, this can be a matter of life and death.

It is interesting to contrast this Ju’hoansi mindset with our own. We believe in merit, we believe in rewards for success. We like to believe that we live in meritocracies – in fact, believing that we do reflects our need for fairness – and so rewarding success is only right. We can perhaps see echoes of the Ju’hoansi approach in the banter that we experience in office environments, and in the tall poppy syndrome to which we are prone, where we tend to denigrate those among us who stand out. But we also see the opposite:

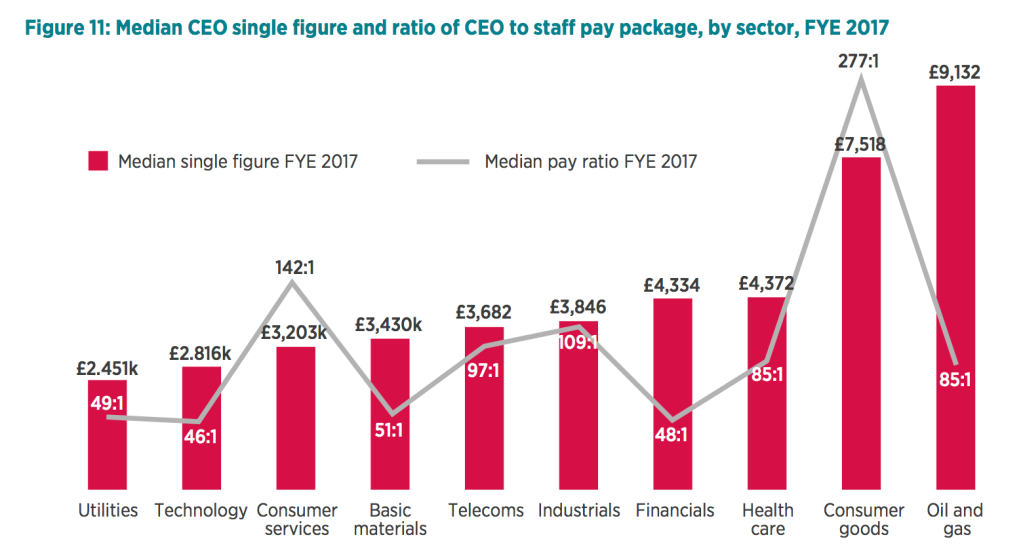

This is a chart from my friends at the High Pay Centre. They are currently updating the numbers to the latest year, but from what I have seen the shape is not markedly different. It shows in effect the opposite of the Ju’hoansi mindset: it shows substantial reward, and in effect praise, for the successful. Just to be clear about the numbers – the red bars show CEO annual pay in thousands, so ranging from over £9 million in the oil and gas business down to a ‘mere’ £2.5 million in utilities. The line shows the ratio between this and the reward for the average worker – sorry, there is no such thing as an average worker – the worker paid in the middle of the range. This ratio shows the variation of CEO pay being around 50 times average pay, to 85 times, 140 times, or indeed 277 times.

I’m sure that there is nothing too surprising in this chart, but I will draw your attention to two things. First, the right-hand side, the two most generous paying sectors – oil and gas and consumer goods. It seems relevant to note that in those sectors the UK has companies that genuinely are global competitors (BP and Shell, and Unilever and Reckitt Benckiser or RB, respectively) and so compete with US rivals; there is a marked contrast in the pay levels with, say the utilities sector, which is a UK domestic industry. The second thing to note is that the ratio is driven less by the pay of the CEO than by the nature and structure of the businesses in question. For example, consumer services, which has a high spike in the ratio, includes retail where we know there are many part-time workers and many who are low-paid; in contrast, the financial sector ratio is much lower because as we know many in financial services are tremendously well-paid.

No doubt all those who are well paid believe that they are well worth it. We live in meritocracies and so of course those who succeed deserve their success. That is the myth of meritocracy, which those who have some success are keen to believe in. They tend to emphasise their own merit and their own hard work, and perhaps to ignore the element of luck that no doubt helped them towards their success – perhaps luck in their start in life or in terms of a lucky break, or otherwise. We do not live in as meritocratic societies as we might like to believe, but we still fall prey to the myth of meritocracy. And the evidence is that believing in meritocracy allows us to put up with more inequality than we might otherwise do: people around the world are much less likely to correct manifestly unequal allocations if they are told there is some (however tenuous) connection to merit or hard work than they are if they are told it arises from luck.

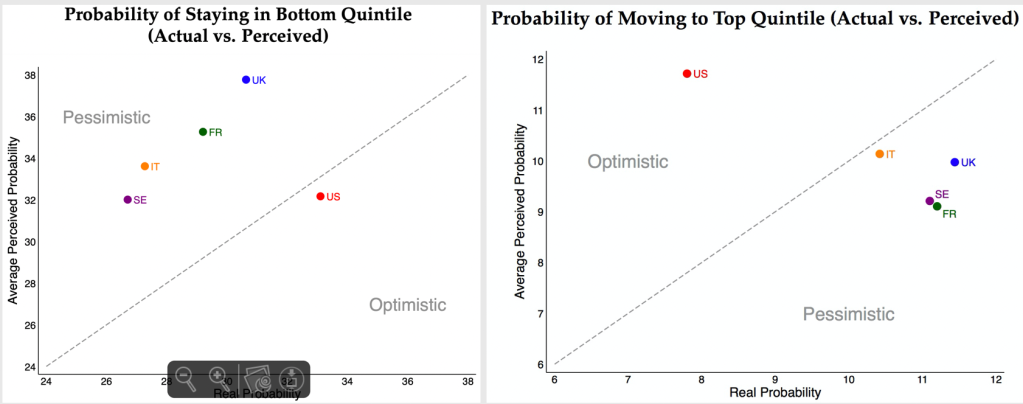

And while we believe in meritocracy, we do not live in meritocracies:

These charts are from a recent presentation by a US academic, looking at perceptions of how meritocratic societies are – which, after all, is one measure of how fair they are. This shows how difficult it is for someone born into the bottom quintile of society financially – the bottom 20% – to escape from that quintile, and also to break into the top quintile – the top 20% – financially. Just to state the obvious, in genuinely meritocratic societies these numbers would be 20%, or very near to it. And all of the countries that we are looking at here are a long way from that 20%. But it’s worse for the US, because they are frankly delusional about how meritocratic their society is. In both senses US citizens believe their country is more meritocratic than the perceptions in the other countries studied, and in both cases it is by some margin the worst in reality. This enables that nation to accept much more inequality than other countries – truly that fantasy is the American Dream.

While we may enjoy a little more realism in the other countries, we cannot pretend to ourselves that they are genuinely meritocratic as each is a very long way from 20% in both cases. Perhaps we need a little more Ju’hoansi thinking.

So that is a very brief view of what fairness is, how central it is to our view of ourselves as humans and of the communities in which we want to live, and of some of the implications of the distance we currently are from fairness.

So to turn to what this might mean for us as investors. I have one suggestion for a space to explore in terms of investment opportunity, and three areas (each with two arms) to consider in our broader investment and stewardship approach.

Taking the investment opportunity first, I believe that there must be an opportunity in providing opportunity, in leaning against the unfairness and barriers to advancement in our society. That might mean investing in deprived areas to generate economic activity and more opportunity for those who currently face barriers. Given that successful investing is buying cheap assets in the expectation of valuation improvements, at the very least it is worth considering as there are cheap assets to invest in and improve.

To take the other three areas in turn:

- Supply chains

- First, there is an economic problem with supplier relationships. The purchasers, typically larger companies, require suppliers to finance the supplies – they take goods on credit, at 30-day terms or 60-day terms. So the cost of financing the supply chain sits with the supplier rather than the purchaser. Given the purchaser is as I say typically larger, its cost of finance is lower so there is a clear economic cost from this unequal relationship.

- Second, the impact of the downwards pressure on pricing leads to bad things happening in supply chains. We have seen stories just this week about inappropriate behaviours at suppliers in India, we know the stories about the abuses within fast fashion supply chains in the great city of Leicester; more broadly, we know deforestation is driven by our demand for cheap products. We need to look harder at supply chains.

- Tax

- The responsible tax movement is growing and it is really important. More companies need to be challenged to be responsible taxpayers, to ensure they pay a fair level of taxation in their countries of operation. Too much profit is syphoned away into tax havens and we need more honesty and fairness over tax.

- We as investors need to look at our asset classes beyond listed equities. In particular, we should look at our private equity and fixed income portfolios. Too often, companies are thinly capitalised and financed with heavy debt loads, reducing their profits and so their tax load. Too much of private equity return arises from this tax arbitrage, and possibly too much of the debt in many portfolios is playing the other part in this game. Companies with too much debt have proven not resilient enough in this crisis, and we need to consider this actively – as well as the simple fairness of ensuring that the exchequer receives a fair level of tax.

- Executive pay

- I would actually suggest that in the UK and Europe it would be better to look not at CEO pay – remember that in the UK we have successfully held down CEO pay for around the last seven or eight years – but at the other end of the pay ratio, the pay of the least well off. I would suggest a focus there, on contractors as well as staff, might lead us nearer to fairness.

- Put simply, if you are not already leaning hard against the levels of executive pay in the US, you should be. As we saw in the rewards for consumer goods companies and oil and gas businesses, the high levels of executive pay in the US infect the world.

Thank you for the opportunity to talk a little about the sense of fairness and also what it might mean for us as investors. I’d welcome thoughts and questions.

Mama’s Last Hug, Frans de Waal, Granta (2019)

Fairness Expectations and Altruistic Sharing in 15-Month-Old Human Infants, Marco Schmidt, Jessica Sommerville, Plos One (2011)

Markets, Religion, Community Size, and the Evolution of Fairness and Punishment, Henrich et al, Science Vol 327 (2010)

Envy’s hidden hand, James Suzman, Aeon, May 2018

Executive pay: review of FTSE 100 executive pay, CIPD and High Pay Centre, August 2018

Perceptions of Inequality Using Social Economics Surveys, Stefanie Stantcheva (Harvard University) January 2020