For all the active discussions about purpose in the context of business, and all the force with which the concept is advocated by its champions, there is a lack of clarity at the heart of the debate. Indeed, too many seem to be seeking deliberately to obscure the fact that there are at least two separate discussions going on. If purpose is actually to deliver on its promise — in the terms used by this blog, fairer business and society — clarity is needed.

Clarity is lacking, though. What’s worse, there seems real disagreement over what a corporate purpose is, and there is even disagreement about what the debate on corporate purpose is all about.

At a recent London School of Economics Systemic Risk Centre event on Sustainability and Systemic Risk, I asked law professor David Kershaw what the distinction is between the new agenda of purpose and the former company law model of articles of association including objects clauses which in effect bar companies from acting ultra vires, beyond their stated scope. This objects clause approach was swept away by the Companies Act 2006 (though it had been rendered largely obsolete prior to this by such clauses being drafted incredibly broadly, giving boards in effect almost unlimited freedom). David highlighted that objects clauses set out what the company was there to do, and purpose statements are about how the company does it.

This idea of purpose as the how is to me an attractive one. But there is active disagreement over which of Rudyard Kipling’s six honest serving men purpose might represent.

For example, Douglas Lamont, the CEO of Innocent Drinks, speaking at the British Academy’s Future of the Corporation Purpose Summit offered his own seductively simple outline of how those serving men operate in framing corporate activity:

“Purpose is the why

Vision is the what

Values is the how”

And Patrick Dunne, former 3i executive, in his magisterial but still highly practical new tome Boards (produced by the excellent Governance Publishing) asserts a further version of this (ironically perhaps, discussed in the ‘Process’ segment of a book he divides into 3 sections, ‘Purpose’, ‘People’ and ‘Process’):

“Vision: What we want to see happen

Purpose: Our contribution to making that vision a reality

Mission: A description of what we actually do

Strategy: How are we going to make it happen”

“Deciding what they [these four plus also brand and culture] should be is one of the most fundamental things for a board and management team to determine,” Dunne says.

The confusion is still worse in some cases, where purpose appears to fulfil multiple roles at once. Take one of the most quoted statements on purpose, Larry Fink of Blackrock’s 2019 letter to investee company CEOs. This shifts from one perspective on purpose to another from sentence to sentence: “Purpose is not a mere tagline or marketing campaign; it is a company’s fundamental reason for being — what it does every day to create value for its stakeholders. Purpose is not the sole pursuit of profits but the animating force for achieving them.” Here, purpose is simultaneously both ‘what’ and ‘why’ it seems.

But the disagreement goes deeper. It is not just about what purpose is and what it means, but about at what level corporate purpose is being discussed. One of the challenges with business purpose is that there are two very separate conversations going on, and rarely is a clear distinction drawn between them. Indeed, some of the leading proponents of the question of purpose elide the distinction almost entirely. One conversation is about a business’s purpose — what is the driving force for an individual company’s operations — and the other about the purpose of business — what is the overarching role of business corporations in economic life and society as a whole. For example, while the bulk of the focus on purpose in the British Academy’s work on the Future of the Corporation is about individual companies, it does not shy away from brassily huge assertions such as “the purpose of business is to solve the problems of people and planet profitably, and not profit from causing problems”.

This wide-reaching version of the corporate purpose debate is well illustrated by an article and blog from a pair of law professors from Rutgers, Can a Broader Corporate Purpose Redress Inequality? The Stakeholder Approach Chimera. This sees the debate about purpose purely in the sense of the overall purpose of corporations generally, and seems to take for granted that currently US companies can only consider narrow shareholder interest (a view disputed in Accountable Capitalism). And it views a switch from this shareholder-centricity to a stakeholder model as risky because it is likely further to entrench corporate management: “a stakeholder approach is unlikely to achieve meaningful redistribution of power and resources to weaker constituents and would likely work in the opposite direction. We suggest that a stakeholder approach gives corporate executives both a sword and a shield with which to preserve their advantageous status quo.”

The authors take their cynicism about the Business Roundtable purported restatement of corporate purpose beyond that of the major US investment institutions represented by the Council of Institutional Investors (see The limited responsibility company), and argue that this is not just entrenchment of current power structures but an active distraction from addressing fundamental problems in society: “in our view the entire debate over corporate purpose has so far revolved around the wrong question: it has centered on whether directors are disproportionately focused on shareholders’ interests, neglecting the more important questions of why are weaker constituencies faring so bad in modern-day American capitalism and what can actually be done to elevate their interests”. They believe that these issues would be better solved with more direct interventions, such as changes to labour, tax and competition laws.

This is certainly a worthy debate, but I think focusing the discussion on corporate purpose with regard to the individual company and what it is aiming to do is both more practical and more immediately needed. It should help individual companies prosper and succeed. That certainly seems to be the intent of the FRC in bringing purpose very clearly into the board’s remit in the Corporate Governance Code. Principle B states “The board should establish the company’s purpose, values and strategy, and satisfy itself that these and its culture are aligned.” It does not explain much of what it means by this, other than framing it in terms of long-term success and the business in the context of its stakeholders, and the need to ensure that “policy, practices or behaviour throughout the business are aligned with the company’s purpose, values and strategy”, and that executive pay is also so aligned.

According to David Kershaw and his LSE colleague Edmund Schuster, this introduction of purpose in the Corporate Governance Code is a potential watershed moment, a “purposive transformation of company law”. They suggest this even while noting the FRC’s omission of a definition of purpose, and so the scope for misunderstanding. Again, their focus is on the broader horizon of the overall purpose of the corporation, and they argue that the shareholder-friendly nature of UK company law will frustrate the intent of purpose. They appear to have little trust in the concept of enlightened shareholder value as embodied in s172 of the Companies Act, and the view that a focus on stakeholder interests facilitates long-term value creation for all, including shareholders. Instead they argue that company boards and management will only feel empowered fully to reflect their stated purposes if they have a ‘zone of insulation’ from the usual pressures of the financial markets. In effect, they disbelieve the fine words of institutional investors and think that in practice they will simply favour their own interests as shareholders.

This, though, is surely a chicken and egg situation: shareholders supportive of purpose are drawn to companies with clear, publicly stated and lived purposes, just as much as companies with supportive shareholders are able to develop and assert a purposeful approach. I have argued elsewhere that one reason Unilever was able to survive the bid approach from aggressively managed Kraft-Heinz was because it had previously set out its stall as a long-term business. When Paul Polman started as CEO one of his first acts was to abandon quarterly reporting, encouraging a longer term mindset among shareholders. It put off some investors but encouraged others, meaning the shareholder base was longer term when the hostile approach came. Given the subsequent near-implosion of Kraft Heinz as its zero budgeting model reached its natural come-uppance (as all under-investment will in time), those longer-term shareholders have served themselves — and their clients — well. They also acted in a way that served the interests of Unilever’s employees, customers and suppliers.

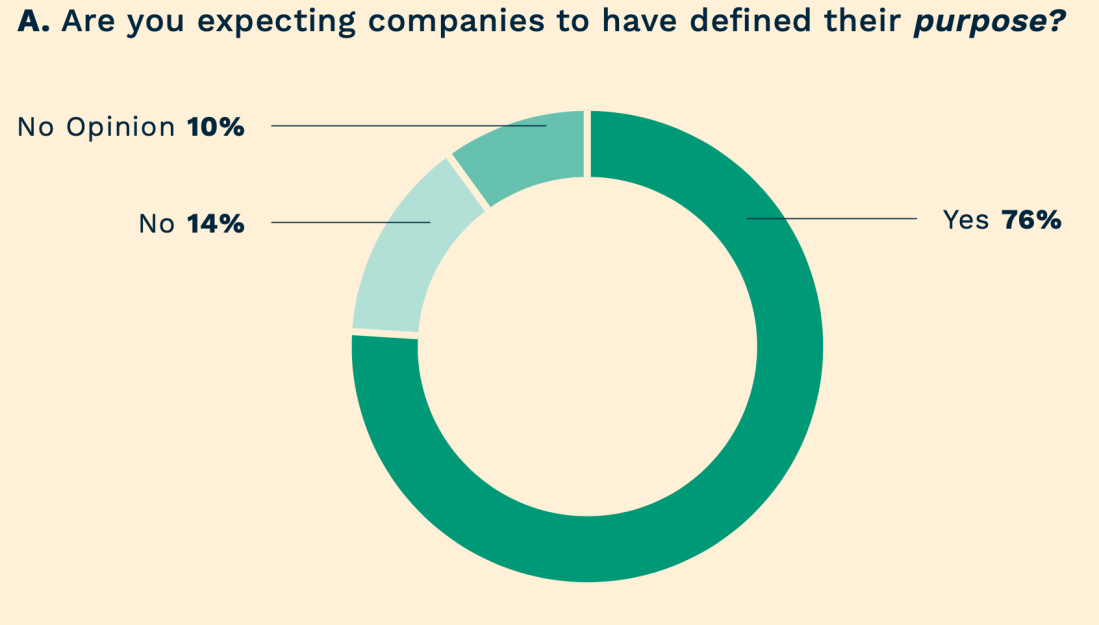

Despite the professors’ mistrust, it would seem that institutional shareholders genuinely are ready to embrace purpose, if they believe that managements are themselves committed to them. My friends at SquareWell recently surveyed institutions on the topic, receiving responses from firms with a total of $22 trillion in assets. Not only are these institutions supportive of purpose, more than three-quarters are expecting companies to have set out their purpose:

Furthermore, fully 86% expect some sort of declaration that the company has successfully fulfilled its purpose over a relevant reporting period. And they expect purpose to be concrete enough to be measurable: some 75% of these investors believe that KPIs should be set and disclosed with regard to the delivery of purpose, and 59% believe that those KPIs should affect executive pay. Personally I think that this risks attempting to measure the unmeasurable, and certainly it is a further example of the investment community expecting companies to do things they themselves are not yet doing, given that only 22% of the sample have actually themselves incorporated purpose issues into their evaluations of ESG.

Yet in practice uptake of purpose in a formal way has been limited. The SquareWell team report: “In the French market where companies have the opportunity to amend their bylaws to define their ‘raison d’être’, which requires shareholder approval, less than ten companies have taken the leap. Most companies are reluctant as they fear creating new legal risks while they are not convinced of the benefits. The ones which have done so received very high level of shareholder support though.” My informal discussions with investors also indicate a nervousness about the lawyering that is likely to be involved in any incorporation of purpose into bylaws or articles of association, which might risk making purpose meaningless; however, 41% of SquareWell’s surveyed investors believe that the purpose should be so enshrined (though this is fewer than those believing that it is more appropriate for purpose to be asserted through a regular statement in the annual report or otherwise by the board — 55% and 45% respectively).

One example of a French company that has adopted purpose formally was Danone, which at its AGM in June 2020 won no less than 99.4% approval for such a move. Its declared purpose does not seem to have been narrowly lawyered to the extent it is meaningless; indeed, it is general and broad: “The purpose of the Company is to bring health through food to as many people as possible.” Under the société à mission model, the corporate form that Danone has switched to, the company is held to account for delivering on this purpose through the oversight of a special committee, independent from the board (though the rules allow board directors also to be members). This committee’s role is to monitor delivery against the purpose, and to produce an annual report to that effect.

Elsewhere, much has been made by a few commentators of recent IPOs by some B Corps, a corporate model that puts stakeholder interests before those of shareholders. This, they suggest, is a sign of purpose potentially driving changes to business behaviour. Notable amongst these has been insurance business Lemonade, which listed on NYSE at the start of July. “As a public benefit corporation, our focus on a specific public benefit purpose and producing a positive effect for society may negatively impact our financial performance,” states the IPO prospectus in its lengthy Risk Factors section, apparently highlighting just such change. However, sharp insurance industry commentators Oxbow have highlighted just how little of Lemonade’s money actually ends up heading towards its purported purpose: “anything left over is donated to charity in the annual ‘giveback’. This giveback has been a major emphasis in the company’s marketing, but in reality, it’s a very small proportion of actual spending.” So perhaps the legal drafting of risks is just another element of the breezy sales style of the rest of the prospectus, which at times shades into pomposity. Certainly, some investors believe shareholders will make real money from the company, as the share price leapt nearly threefold on debut and even after a drift downwards values the company at some $4 billion. The prospectus reports total 2019 revenues of just $67 million, and a loss of more than $100 million; ‘giveback’ was around $600,000.

A change in business behaviour is the point. It is the purpose of purpose. As the good people at Blueprint for Better Business say in their excellent recent paper Purpose for PLCs: Time for Boards to Focus: “The business needs to be led by that purpose, seeing itself as a social organisation which cares about people and generates the profit necessary to sustain the pursuit of that purpose.” In the Blueprint analysis, purpose is a discipline, a reason to say no to doing things that, while they may be profitable, do not fit with the purpose — the company’s role in society. “The shift is from a narrow focus on financial value creation alone to a wider, richer view of what a company exists to do in the world.” To my mind this paper is one of the clearest contributions to the debate, short and usefully to the point. It goes on:

“While some stakeholder relationships are more material to business success, being purpose-led means seeking to have a positive impact on all those whose lives are touched by the company, avoiding manifest unfairness to anyone.”

This is the purpose of purpose, unlocking the opportunity of positive impact through business — and perhaps more importantly, having a reason to avoid negative impacts, even if they are profitable in the short term. For all of the cynicism that the noise around corporate purpose evokes, not least because so many users of the term seem to have no real intention to change anything that they do, and all the disagreement about what it actually means, there is a big opportunity for positive impact. Establishing a corporate purpose does need to change what a company does, perhaps on all the dimensions of what, why and how. By each company seeking to have a purpose that goes beyond the simple generation of short-term profit but that instead looks to generate long-term prosperity, we are more likely to achieve that economic prosperity. A broader and larger economic prosperity can then be more fairly shared between stakeholders. Perhaps we should do that on purpose.

See also: What’s the purpose of purpose? (II)

Purpose for PLCs: Time for Boards to Focus, Blueprint for Better Business, 2020

The Purposive Transformation of Company Law, David Kershaw, Edmund Schuster, LSE Law, Society and Economy Working Papers 4/2019

Boards, Patrick Dunne, Governance Publishing 2019

Profit & Purpose, letter to CEOs 2019, Larry Fink, BlackRock

Principles for Purposeful Business, How to deliver the framework for the Future of the Corporation, The British Academy, 2019

Can a Broader Corporate Purpose Redress Inequality? The Stakeholder Approach Chimera, Matteo Gatti, Chrystin Ondersma, forthcoming Journal of Corporation Law, 2020

Also Oxford Business Law blog, June 11 2020

Making Corporate Purpose Tangible, SquareWell, 2020

Also Harvard Law School Forum on Corporate Governance blog, June 19 2020

Who’s drinking all the Lemonade?, Oxbow Partners, July 30 2020

Lemonade IPO Prospectus, 2020

2 thoughts on “What’s the purpose of purpose? Will the focus on corporate purpose deliver real change in the way companies behave?”

Comments are closed.